Senior Citizens Health Insurance: Taxation and Investment Benefits Available

Investing in a senior citizen health insurance not only assures the health and quality medical services to them, but also has several tax benefits. Most senior citizens do not have a regular source of income, and earn mostly through pensions. In some cases, they could still be earning a salary or consultancy incomes.

To maintain their household expenses, seniors have to be mindful of the taxation liabilities, as well as invest smartly. A health insurance policy for seniors has a lot of taxation benefits, and exemptions. Considering buying a senior citizen health insurance policy? Read ahead to know about the 10 benefits exclusively available for you.

Exemptions for income tax: Income tax exemption limits are different for seniors. People who are within 60 to 80 years of age get a tax exemption on income up to Rs. 3 lac annually. Their income is tax free till that amount. For seniors over 80 years of age, income tax exemption is for income up to Rs. 5 lac.

ITR filing: Unlike other citizens, senior citizens need not file online. Senior citizens can file income tax returns Form ITR 1 and ITR 4 in paper mode. However, they can opt for e-filing if they wish.

ITR filing exemption: According to Section 194P of the Income Tax Act of 1961, senior citizens are exempt from filing income tax returns if they are older than 75 years of age. These seniors must be citizens or residents of India.

Interest income deductible: As per Section 80TTB of the Income Tax Act, there are provisions relating to the interest income accrued from deposits made with banks, post offices, or cooperative banks. If the deposit amount of a senior citizen is up to Rs. 50,000, the amount is eligible for deduction with regard to interest income. This is valid for interest earned on both savings and fixed deposits.

Advance tax payment: According to Section 208, any person with a tax liability of more than Rs. 10,000 per year, must pay the tax in advance. This is called advance tax. However, Section 207 days that resident seniors are not required to pay the advance tax.

As long as the senior citizen does not have any income from a business or a profession, they do not have to pay advance tax.

TDS exemption: TDS stands for Tax Deductible at Source. As a senior citizen, if the annual income is within the exemption limit, they can submit a Form 15H to the bank, for non-deduction of the TDS. Ideally, the form 15H must be submitted in April every year.

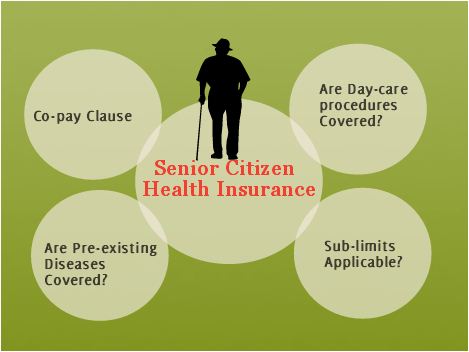

Medical insurance premium: Senior citizens get a greater tax benefit against a senior citizen health insurance premium payment. If the senior is more than 60 years of age, any premium payment made towards self, spouse, or children, a maximum deduction of Rs. 50,000 a year is allowed. If the senior makes a premium payment for their parents, the deduction increases to Rs. 1 lac.

For citizens below 60 years, the deduction allowed is only Rs. 25,000.

Section 80DDB of the Income Tax Act has provisions for tax deductions on expenses incurred on the treatment of specific diseases and illnesses. The maximum deduction in this case is Rs. 1 lac.

Extra premium on bank FD: Fixed deposits with banks offers a greater interest rate to senior citizens. Generally, an extra amount of 0.5% is given to seniors. The increased bank rate is also applicable for tax-saving deposits opened with the bank. To avail these benefits, age proof is required to be submitted to the bank.

Senior citizen saving scheme: The government has introduced a Senior Citizens’ Saving Scheme (SCSS). This scheme is available only for senior citizens of India, and has a five-year tenure, but can be extended for three more years. The maximum investment is Rs. 15 lac, and more than one account can be opened. The scheme pays interests on a quarterly basis, and is fully taxable.

Key takeaways

As a senior citizen, there are many taxation benefits that can be availed by investing and under a health insurance policy. These benefits are available exclusively for senior citizens, and allows them to live an independent life without compromising on anything.