What Are The Various Ways You Could Keep Track Of Invoices?

For those who work in the account payable process, the ideal workday might include many essential tasks like managing invoice payments, conducting spend analysis, fostering positive vendor relations, etc. In reality, however, many of those in this position spend most of their time sending reminders for invoice approval, manually entering data, correcting invoice processing errors, and similar tasks. Continue reading if the latter describes the cycle your accounts payable team—or your one-person financial department—is trapped in, and you’re ready to break free.

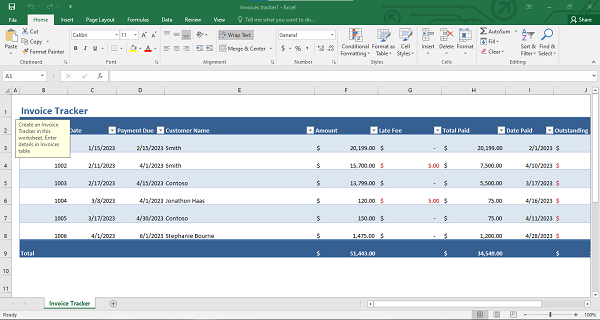

Managing invoices involves keeping track of each one from when your company receives it until you pay it. Verifying an invoice’s validity and accuracy, speaking with the appropriate parties to secure payment authorization, and recording the payment in the business’s records are some of the steps that may be involved in this process. These steps are necessary to maintain the accuracy and timeliness of your overall accounting. Invoice management is a complex process with lots of moving parts, and numerous people and organizations can send invoices to your company, including vendors, consultants, and suppliers.

Many factors affect how you keep track of invoices, regardless of the size of your company or whether you have a full-fledged accounts payable (AP) team. And with that, let me explain why it’s important to prioritize creating a system that makes it easier for your company to keep track of invoices. Numerous businesses have automated at least a portion of their accounts payable procedure, for example, by scanning invoices. However, a disproportionate number of businesses continue using manual invoice methods.

A manual invoice management process might begin with an emailed invoice that AP automation software is ready to input into an accounting system. However, organizations that follow largely manual AP procedures might print out an email-received invoice afterward and handle tasks like three-way matching, purchase orders, and receipt reports on their own, or they might ask for payment approvals. The good news for businesses that still need to automate their AP operations fully is that it’s simple to continue where a company has left off and complete the task.

AP automation can significantly reduce the amount of time needed for invoice management. These days, it’s designed to gather approvals, match invoices with other vital documents, and automatically input them, among other time-saving features. Forget the gloom and the unnecessary work for AP staff.

You’ll be able to significantly streamline your operations if you have a system that specifies how to manage invoices across every team member. Software for AP automation may even be cost-effective for a large enough volume of invoices. Most teams in charge of handling invoice processes feel overworked. They are not only overwhelmed by the nearly impossible volume, each of which requires considerable mental effort.

The bright side of this scenario is that how you handle invoices can turn a previously overwhelming task into a manageable one with tools and strategies that prepare your team to handle anything vendors regularly throw at them. When you’re ready to figure out how to keep track of invoices from start to finish, accounts payable automation is the answer.