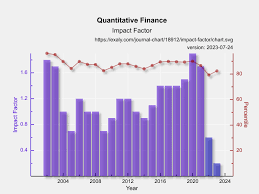

Building A Career in Quantitative Finance Through the Lens Of Data Science

Quantitative finance is a field that involves the application of mathematical and statistical models to financial data. Data science, on the other hand, involves the use of statistical and computational techniques to extract insights from large and complex datasets. As such, data science has become increasingly important in quantitative finance, as it provides new tools and techniques for analysing financial data.

Building a career in quantitative finance through the lens of data science requires a combination of skills and knowledge in both areas. In this article, we will explore some of the key skills and strategies for building a successful career in this field.

Getting Started

The first step to building a career in quantitative finance through data science is to obtain a solid foundation in both areas. This typically involves obtaining a degree in a relevant field, such as finance, mathematics, statistics, or computer science. Attaining a career in data science will be made easier by taking part in a course that teaches elements of these topics. A typical example of one of these courses is the Certificate of Quantitative Finance, a program that teaches all the necessary elements of data science necessary to get a career in financial data science.

In addition to academic and practical experience, it is important to develop a strong set of technical skills. This includes proficiency in programming languages such as Python, as well as experience with statistical modelling and machine learning techniques.

Staying Updated and Networking

Networking is also critical in building a career in quantitative finance. This includes attending industry events, joining professional organizations, and connecting with others in the field through social media or online forums. Building relationships with mentors and peers can provide valuable insights and opportunities for growth.

Another key strategy for building a successful career in quantitative finance through data science is to specialise in a particular area or niche. This could involve focusing on a specific financial instrument, such as options or futures, or a particular type of analysis, such as risk management or algorithmic trading. By developing expertise in a particular area, you can differentiate yourself from other candidates and demonstrate your value to potential employers.

It is also important to stay current with developments in both quantitative finance and data science. This may involve attending conferences and workshops or reading academic journals and industry publications. By staying up to date with the latest trends and techniques, you can continue to improve your skills and position yourself as a valuable asset to employers.

To summarise, building a career in quantitative finance through the lens of data science necessitates a mix of technical knowledge, practical experience, and networking. You can position yourself for success in this exciting rapidly evolving field by obtaining a good foundation in both areas, specialising in a specific expertise, and staying current with advances in the field.

Apart from this, if you are interested to know more about Employee Education Tips then visit our Education category